OMiP / Company Overview / Group History

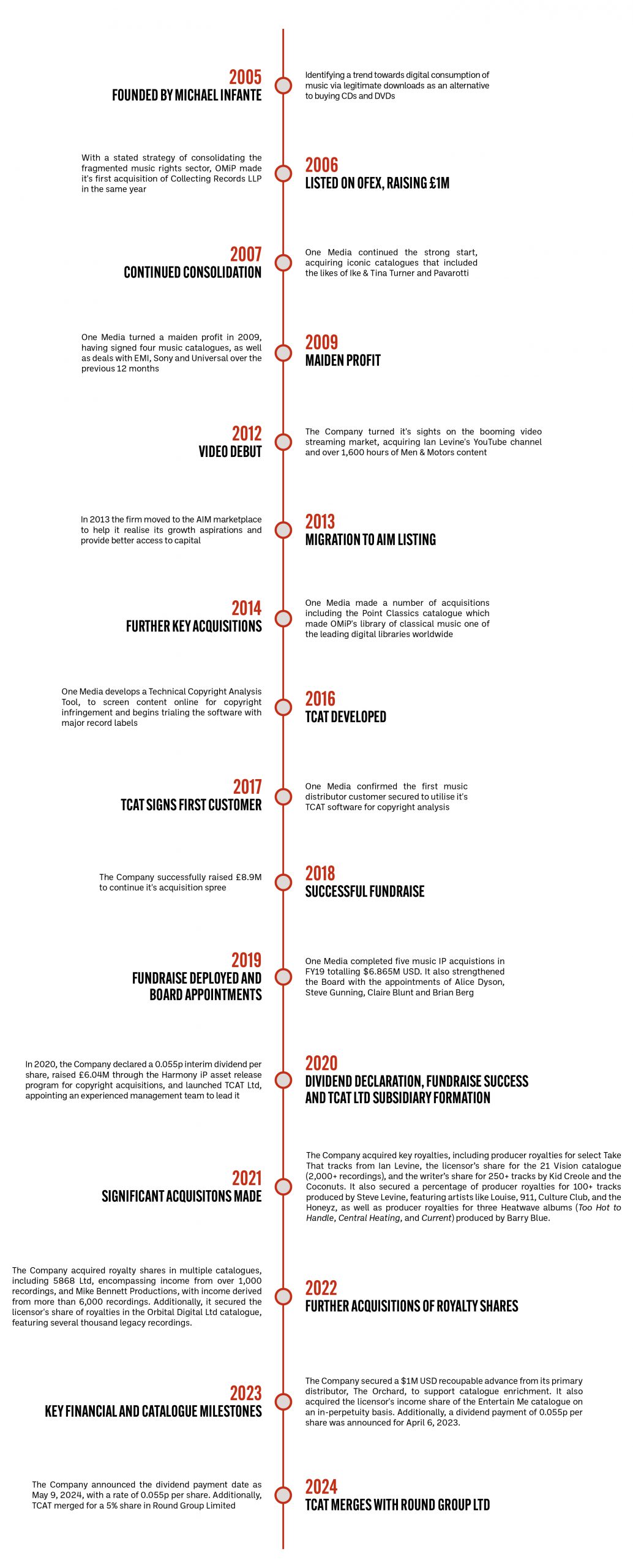

Group History

One Media IP Group PLC Overview

Introduction

One Media IP Group PLC (www.omip.co.uk) is an intellectual property (IP) owner and controller of music and video rights. The company operates both B2B and B2C, licensing its IP to over 600 digital music and video stores worldwide. OMIP’s catalogue includes over 400,000 nostalgic music tracks and 10,000 hours of video content, ranging from classical to rock genres. Notable artists include George McCrae, Don Williams, Mago De Oz, Anita Harris, Mungo Jerry, Philip Wesley, Kid Creole and Troggs, among many others.

OMIP also owns Men & Motors, a YouTube channel with over 3,400 shows available (Men & Motors YouTube). The company is exploring opportunities to bring this content to digital TV broadcast. Additionally, OMIP’s creative technicians utilise proprietary software to digitise and manage content, making it available for use in TV shows, movies, adverts, and websites.

Company Overview

Founded in 2005 by Michael Infante, One Media IP Limited began as a digital music content distribution business, specialising in acquiring content from the 1960s to the 1990s. OMIP identified the potential of digital music platforms such as Apple, Spotify, YouTube, Tik Tok and Amazon (and 44 other digital platforms) early on, building its foundation to capitalise on this evolving market. Over the past two decades years, OMIP has grown consistently in terms of profit, cash flow, and operational success.

By 2010, OMIP had become a prominent independent player in the digital music market. Its operational model, based on outsourcing non-core activities and maintaining strong business relationships, has since been widely adopted across the industry.

Key features of OMIP’s operations include:

– Proprietary systems to manage over 400,000 music tracks.

– In-house management of metadata accuracy and efficient content delivery.

– Royalty payments across 240 territories in multiple currencies.

– Vigilance across 600 digital stores using proprietary software for optimal rights management and performance.

Financial Performance and Outlook

OMIP generates a substantial portion of its revenue in US dollars, benefitting from favourable currency exchange rates. With expenses primarily in UK sterling, OMIP’s financials are well-insulated against economic fluctuations.

Streaming services continue to drive the resurgence of recorded music sales, positioning OMIP to benefit from the growing digital music market. The company’s renewed focus on music acquisitions further bolsters its growth outlook.

Description of Activities

OMIP’s core activities focus on acquiring and exploiting IP rights in music, video, and spoken word. Its licensing services cater to TV, film, advertising, and more. Recent activities include the integration of TCAT operations into Round Group Ltd., broadening OMIP’s interests into digital marketing and technical services, while retaining access to TCAT’s expertise.

Present Performance

OMIP continues to meet broker expectations with robust financial performance. The company has maintained consistent revenue and profit growth, cash generation while delivering dividends to shareholders, even in challenging times. Its strong balance sheet supports sustainable growth and cash generation.

Future Outlook and Strategic Plans

OMIP is strategically positioned for continued success. The company is redirecting focus to its primary activities of acquiring music back catalogues and legacy tunes. With a strong pipeline of potential music acquisition deals, OMIP is poised to build on its successful history in the music rights industry.

As both the music and software sectors transform, OMIP’s future is anchored in its core strengths:

- A renewed focus on music acquisitions promises fresh growth opportunities.

Summary: Why Invest in OMIP?

1. Established Track Record: A proven history of consistent revenue and profit growth.

2. Market Thought Leader: A recognised leader in the digital music distribution industry.

3. Innovation and Technology: Proprietary software for its in-house operations such as its music ingestion systems, royalty reporting and contract systems and cutting-edge tools like the development and TCAT (now successfully merged into the Round Group (https://thisisround.com) ) ensure competitiveness in the digital landscape.

4. Strategic Growth Initiatives: Expansion into emerging markets and anti-piracy software demonstrates proactive growth strategies.

5. Refocused Core Business: A renewed emphasis on acquiring music back catalogues offers significant growth potential.

6. Strong Management Team: Prudent financial strategies and a capable leadership team enable resilience and long-term value creation.

Conclusion

OMIP represents a robust investment opportunity, offering dual growth avenues in digital music and innovative music software. With a strong track record, market leadership, and innovative strategies, OMIP is poised to capitalise on emerging opportunities. As the digital music industry expands and new technologies evolve, OMIP provides investors exposure to two dynamic markets with significant upside potential.

Consistently ahead of the curve throughout a period of rapid change